|

IRS has released the Code § 280F depreciation limits for business passenger automobiles placed in service by the taxpayer in 2018, taking into account the changes made by the Tax Cuts and Jobs Act . IRS has also released the annual income inclusion amounts for such vehicles first leased in 2018. The tax law limits the amount you can deduct for depreciation of your car, truck or van. The § 179 deduction is also treated as depreciation for purposes of these limits. The maximum amount you can deduct each year depends on the year you place the car in service. The 2018 luxury vehicle limits are below. The TCJA modified Code § 168( k) to extend the additional (bonus) first-year depreciation deduction for qualified property acquired and placed in service after Sept. 27, 2017, and before Jan. 1, 2027. Under the TCJA, a 100% bonus first-year deduction of the adjusted basis is generally allowed for qualified property acquired and placed in service after Sept. 27, 2017, and before Jan. 1, 2023 (for certain property with longer production periods, the end date is increased by one year). In later years, the first-year bonus depreciation deduction phases down, as follows:

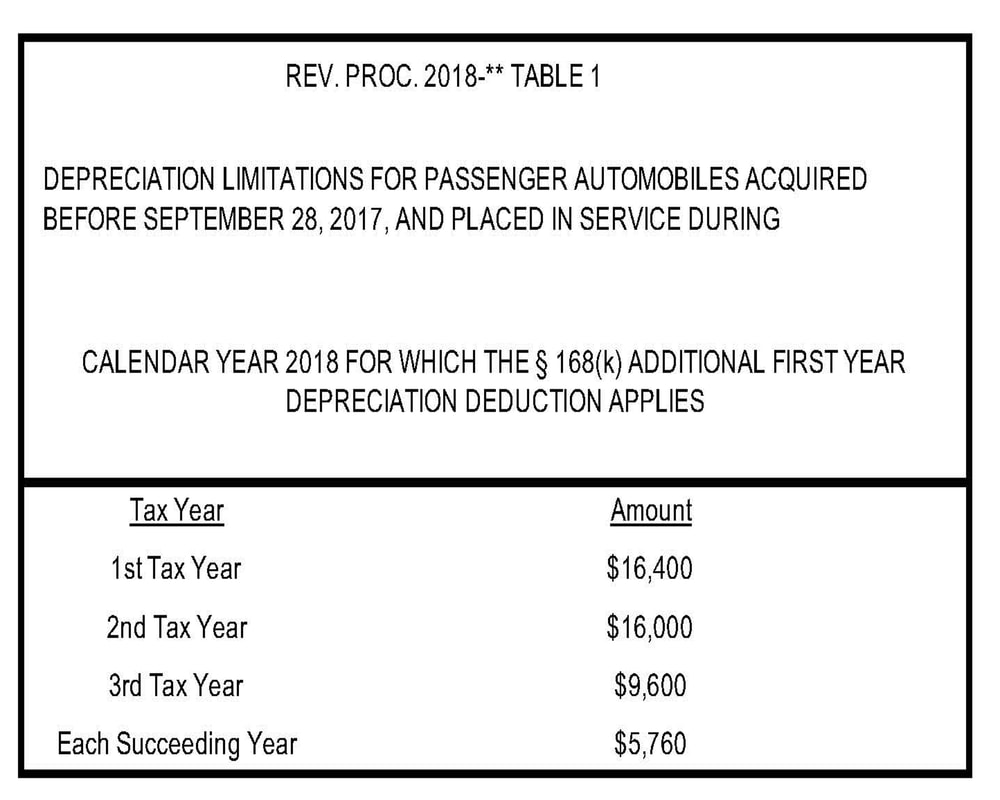

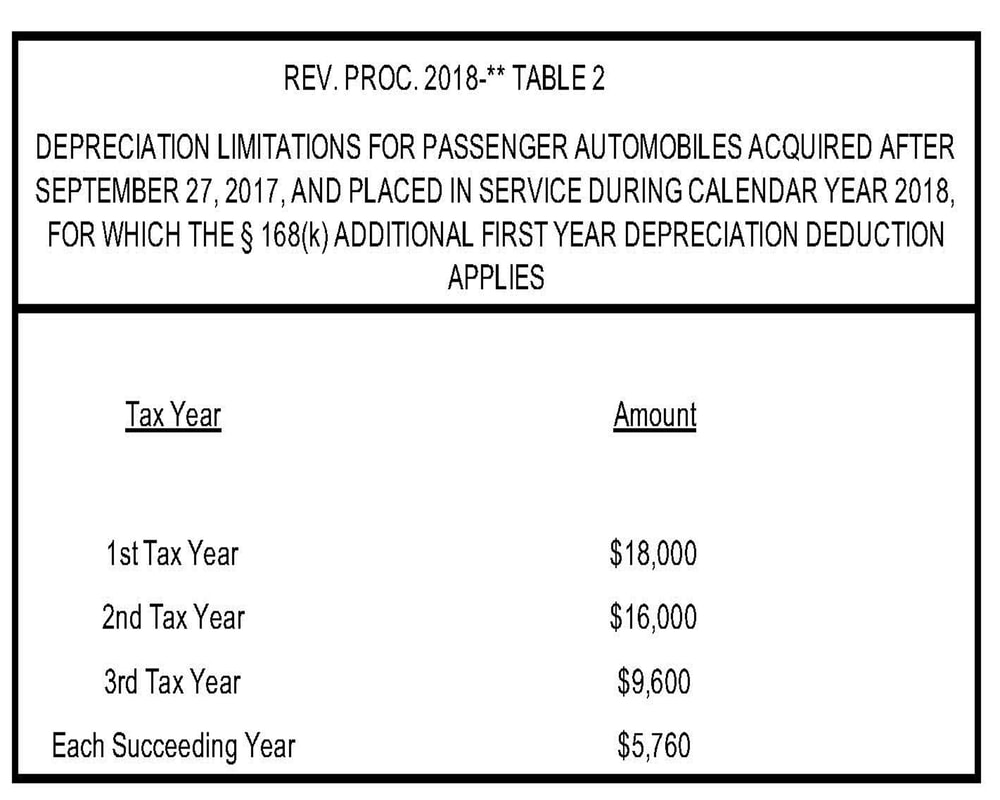

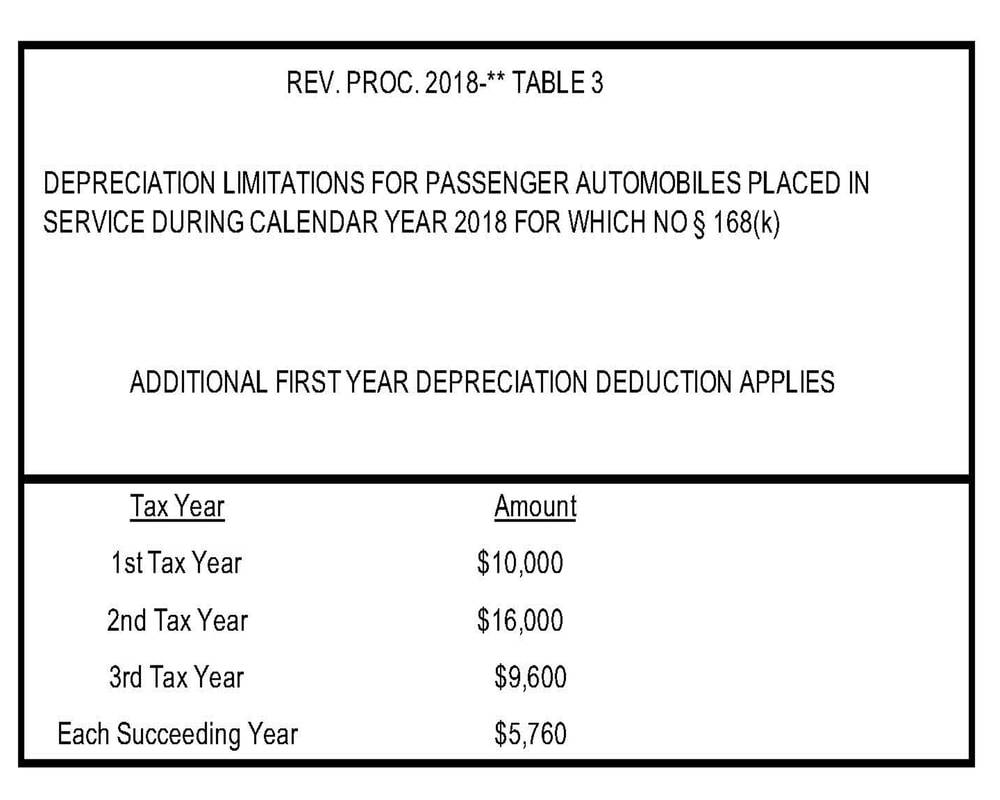

In the case of a passenger automobile, for qualified property acquired by the taxpayer before Sept. 28, 2017, and placed in service by the taxpayer during 2018, Code § 168( k)))(2)(F)(iii) increases the first-year depreciation allowed under Code Sec. 280F by $6,400. For qualified property acquired and placed in service after Sept. 27, 2017, Code § 168( k)(2)(F)(i) increases the first-year depreciation allowed under Code § 280F by $8,000. Guidance. The following are the annual depreciation dollar caps for vehicles that are subject to the luxury auto limits of Code § 280F and are placed in service by the taxpayer in calendar year 2018. As Code § 280F(a), as amended by the TCJA, provides the limits on depreciation for passenger automobiles placed in service during calendar year 2018, no adjustment for inflation applies to calendar year 2018. The depreciation limits for passenger automobiles acquired by the taxpayer before Sept. 28, 2017, and placed in service by the taxpayer during calendar year 2018, for which the Code § 168( k) bonus first-year depreciation deduction applies, are: The depreciation limits for passenger automobiles acquired by the taxpayer after Sept. 27, 2017, and placed in service by the taxpayer during calendar year 2018, for which the Code § 168( k) bonus first year depreciation deduction applies, are: The depreciation limits for passenger automobiles placed in service during calendar year 2018 for which no Code § 168( k) bonus first-year depreciation deduction applies are:

0 Comments

Leave a Reply. |

We're Here to HelpGet advice from our experienced network of financial managers. If you Value our Blog, We have an ask.We spend hours researching data to help you understand your finances and taxes, including historical context, issues, and solutions. Our goal is to empower people to improve their relationship with money. Please consider a $3 donation today. Important Disclosures

Spencer Accounting Group, LLC does not provide investment, tax, legal, or retirement advice or recommendations in these blogs. The information presented here is not specific to any individual's personal circumstances. AuthorKeana Spencer is an Accountant, Entrepreneur, and Educator to her clients, with a strong passion. Keana has over 10 years of experience and through her practice, she is a source of knowledge and strategies to her clients. |

RSS Feed

RSS Feed