|

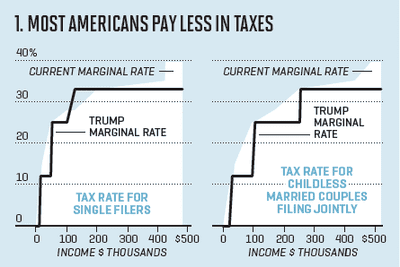

One of the biggest challenges we tax planners face is anticipating how changing laws affect your taxes. Can we feel confident recommending changes today to help minimize taxes tomorrow? This year brings more uncertainty than at any time in the last decade. That's of course because Donald Trump will soon take office as President, with support from a Republican Congress. At this point, it looks like Congress will take up corporate taxes first. Trump has called for dropping business rates to no more than 15%. In exchange, he would eliminate deferral of tax on foreign income, impose a 10% repatriation tax on accumulated profits of foreign subsidiaries, and repeal most business tax incentives other than research and design. As for individual taxes, Trump has proposed cutting rates to a maximum of 33%, boosting standard deductions and capping itemized deductions entirely, and creating new "above-the-line" deductions for health insurance and child care costs. He has also called for repealing gift and estate taxes, alternative minimum tax, and Affordable Health Care taxes. Trump's tax plan is projected to eliminate Personal and dependent exemptions as well as heald of household status. It could eliminate the benefit of itemizing since it is projected to increase the standard deduction anywhere from $15,000 ot $30,000 depending on your filing status. Under Trump's plan there will only be three tax brackets and overall are projected to reduce all Americans tax burden.

0 Comments

Leave a Reply. |

We're Here to HelpGet advice from our experienced network of financial managers. If you Value our Blog, We have an ask.We spend hours researching data to help you understand your finances and taxes, including historical context, issues, and solutions. Our goal is to empower people to improve their relationship with money. Please consider a $3 donation today. Important Disclosures

Spencer Accounting Group, LLC does not provide investment, tax, legal, or retirement advice or recommendations in these blogs. The information presented here is not specific to any individual's personal circumstances. AuthorKeana Spencer is an Accountant, Entrepreneur, and Educator to her clients, with a strong passion. Keana has over 10 years of experience and through her practice, she is a source of knowledge and strategies to her clients. |

RSS Feed

RSS Feed